Introduction

The Tokio Insurance App from IFFCO is the only official mobile app launched by the IFFCO Tokio General Insurance Company Limited one of India’s top general insurance companies. The app was created to make the management of insurance easy, fast and completely digital. Users can purchase renewal, renew, and claim or download insurance policy in multiple categories such as home, motor, health and travel on their phones.

This comprehensive, non-plagiarism-free and SEO-friendly post provides a comprehensive overview that is part of IFFCO Tokio insurance app which includes its advantages, features and setup guides and reviews from users as well as pros and cons and useful tips for maximising the value of this app.

What Is the IFFCO Tokio Insurance App?

The Tokio Insurance App by IFFCO Tokio insurance app is a platform for digital transactions which allows customers to control their insurance policies easily. It removes paper and provides access to vital services like renewal of policies claims submission, tracking and downloading of policy documents.

The app is compatible with all major policies provided through IFFCO Tokio, including motor insurance, health insurance the home, insurance for travel along with personal insurance for accidents.

Basic Information

| Feature | Description |

|---|---|

| Developer | IFFCO Tokio General Insurance Co. Ltd. |

| App Name | IFFCO Tokio Insurance App |

| Category | Insurance and Finance |

| Platform | Android and iOS |

| App Rating (Play Store) | 4.3 (as of 2025) |

| Downloads | 500,000+ |

| Language Support | English, Hindi, and Regional Languages |

| Cost | Free to Download |

| Data Security | Secured, Compliant with IRDAI Data Standards |

Key Features of the IFFCO Tokio Insurance App

The IFFCO Tokio App for Insurance has a broad range of features that help you manage insurance in a simple way. The following are the most popular attributes:

1. Buy New Insurance Policies

Customers can purchase motor or health insurance, travel home, trade, or insurance via the app, without needing to fill out any documentation. Pay safely by using cash, debit card or UPI.

2. Easy Policy Renewal

Renewal existing policies prior to expiry within a couple of clicks. The app automatically sends reminders to ensure users don’t make infractions.

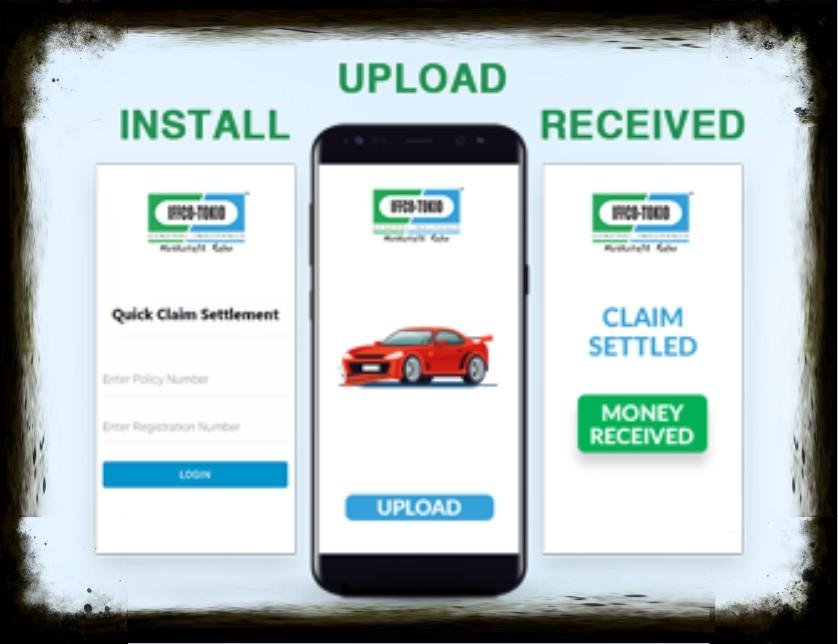

3. Quick Claim Settlement (QCS)

This quick claim Settlement feature lets users raise claims with small sums and receive quicker approvals. This helps reduce waiting times and reduces the need to follow-up manually.

4. Policy Document Access

The app lets users download, share and save the digital versions of policies that are accessible at any time and at any time.

5. Hospital and Garage Locator

Find the closest network hospital for health insurance as well as garages that are authorized for motor insurance with the GPS-enabled map feature.

6. Health E-Card Download

The health card permits the use of cashless services at hospitals in the network. It is available for download directly via the application.

7. Claim Tracking

Monitor claim status in real-time. Users are notified and receive updates regarding claim processing and approvals as well as pending actions.

8. 24×7 Customer Support

Live chat is available or you can helpline support for any insurance related questions. The app also offers FAQs for fast assistance.

Step-by-Step Guide: How to Use the IFFCO Tokio Insurance App

| Step | Process |

|---|---|

| 1. Download | Install the app via either the Google Play Store or Apple App Store. |

| 2. Register | Enter your mobile number registered and email address. |

| 3. Verification | Complete OTP-based verification. |

| 4. Add Policy | Edit existing policy details or buy a new one. |

| 5. Dashboard Access | The main dashboard is where you can renew, claim and download your documents. |

| 6. Track Status | Track claim progress and renewal status in real-time. |

The user-friendly design of the app makes sure that novice users are able to use the app without a hitch.

Benefits of the IFFCO Tokio Insurance App

The Tokio Insurance App from IFFCO offers a variety of benefits to policyholders who are looking for an easy insurance experience.

| Benefit | Description |

|---|---|

| Paperless Process | The elimination of physical documents or forms. |

| Instant Renewals | The renewal of policies can take less than two minutes. |

| Real-Time Claim Tracking | Find out the status of your claim and get immediate updates. |

| Cashless Assistance | Locate a garage or hospital which offer cashless services. |

| Quick Claim Settlement | Quick approvals for smaller claims under QCS. |

| 24×7 Accessibility | 24/7 availability, with all-hours-of-the-day service. |

| Secure Payments | Make use of encrypted and verified payment gateways. |

Sum Insured and Policy Options Accessible via the App

| Type of Insurance | Coverage Range | Key Benefits |

|---|---|---|

| Motor Insurance | Rs1 lakh – Rs25 lakh | Protects against damage to the insured, third party additions, and even zero depreciation. |

| Health Insurance | Rs2 lakh – Rs50 lakh | Hospitalization with cashless, prior – and post-hospitalization coverage. |

| Travel Insurance | 5 lakhs – Rs1 crore | It covers trip cancellations Medical emergencies, trip cancellation, as well as baggage losses. |

| Home Insurance | 2 lakhs – Rs10 crore | Protects against the natural catastrophes and theft and fire damage. |

User Experience and Reviews

Android Users:

- More than 500 000 downloaded which have an average in the range of 4.3 on the Play Store.

- Positive reviews praise the ease of renewal, simple login, and swift access to policies documents.

iOS Users:

- There are some users who report the occasional problems with updating or login however, they generally they find it helpful in the management of claims and policies..

Overall Feedback:

The users appreciate the ease of use and utility in this app. IFFCO Tokio Insurance App However, improvement in the speed of app use and UI design are frequently requested.

Pros and Cons of the IFFCO Tokio Insurance App

| Pros | Cons |

|---|---|

| All-in-one digital insurance platform | Minor bugs in the iOS version |

| Quick renewal and purchase of a policy | Internet connection is required |

| QCS to speed up claim processing | Manual steps to handle high-value claims |

| Secure digital policy access | Some types of policy are not fully integrated |

| 24×7 customer support | UI improvements are required to improve navigation |

Tips for Using the IFFCO Tokio Insurance App Efficiently

- Enable app notifications Receive reminders for renewals and claims updates.

- Use QCS to handle Small Claims – Register small claims using the application for approval in a matter of minutes.

- Keep Your Information Up-to-date – Make sure that the mobile numbers you have registered as well as email address are up to date.

- Copy of the Policy Always download and save digital copies for emergency.

- Search Hospital as well as Garage Networks – Confirm that cashless providers are present prior to travel.

Security and Data Protection

The IFFCO Tokio Insurance App adheres to strict IRDAI-compliant security protocols for data. The user’s data, details about payment as well as personal data are protected by SSL technology. This guarantees complete security throughout the process of claiming and transactions.

Star Virtual Office: A Comprehensive Guide for Insurance Agents

Frequently Asked Questions (FAQs)

Q1. What exactly is IFFCO Tokio App for Insurance utilized to do?

It is used to manage IFFCO Tokio policy on insurance, such as renewals as well as claim filing and downloads of policy documents.

Q2. Can I purchase a new policy via the application?

Yes, you can purchase new policies, such as health, motor, or travel insurance right through the app.

Q3. Does the app allow medical claims for cash?

It is true that the application permits users to search for hospitals within the network and access cashless facilities.

Q4. Does it possible to use the IFFCO Tokio insurance app available for free?

Yes the app is absolutely free to all users and accessible for both Android as well as iOS platforms.

Q5. How secure are transactions through the app?

The app utilizes secure encrypted payment gateways that guarantee data security and transaction security.

Conclusion

The IFFCO Tokio insurance app has revolutionized how policyholders handle their insurance needs. It is a combination of speed, ease of use as well as security by allowing customers to manage all insurance-related services electronically, from purchasing renewals and renewing, to claiming and downloading insurance policies.

If you’re handling the process of a health insurance claim or renewing your motor insurance or simply checking the cashless hospitals you use As a result, IFFCO Tokio Insurance Application will ensure that assistance is at hand. It’s an essential tool for any IFFCO Tokio policyholder who wants an efficient, paperless insurance experience.

Read our Blog